Two Stocks to Plug Into the Doubles Scanner Right Now

For the last few years, it feels like no matter what news story runs on the front page, this market moves in only one direction.

That couldn’t be further from the truth, though...

For every Nvidia (NVDA), up over 800% in the past few years... there’s an Exxon Mobil. Exxon is down 2% in the past three years, and there’s limited reason to think that’s going to change any time soon.

Even in a market performing as strongly as this bull market is, it’s not as simple as “buy everything.”

Fortunately, we’ve identified a system to significantly REDUCE the risk that the next stock you buy will be in the category of underperforming this rolling market – or even worse – crashing hard in the weeks or months ahead.

We’re revealing the entire system on September 17 in a special briefing.

In the meantime, to give you a sneak peek into what we’re seeing, we’ve created a simple tool for you...

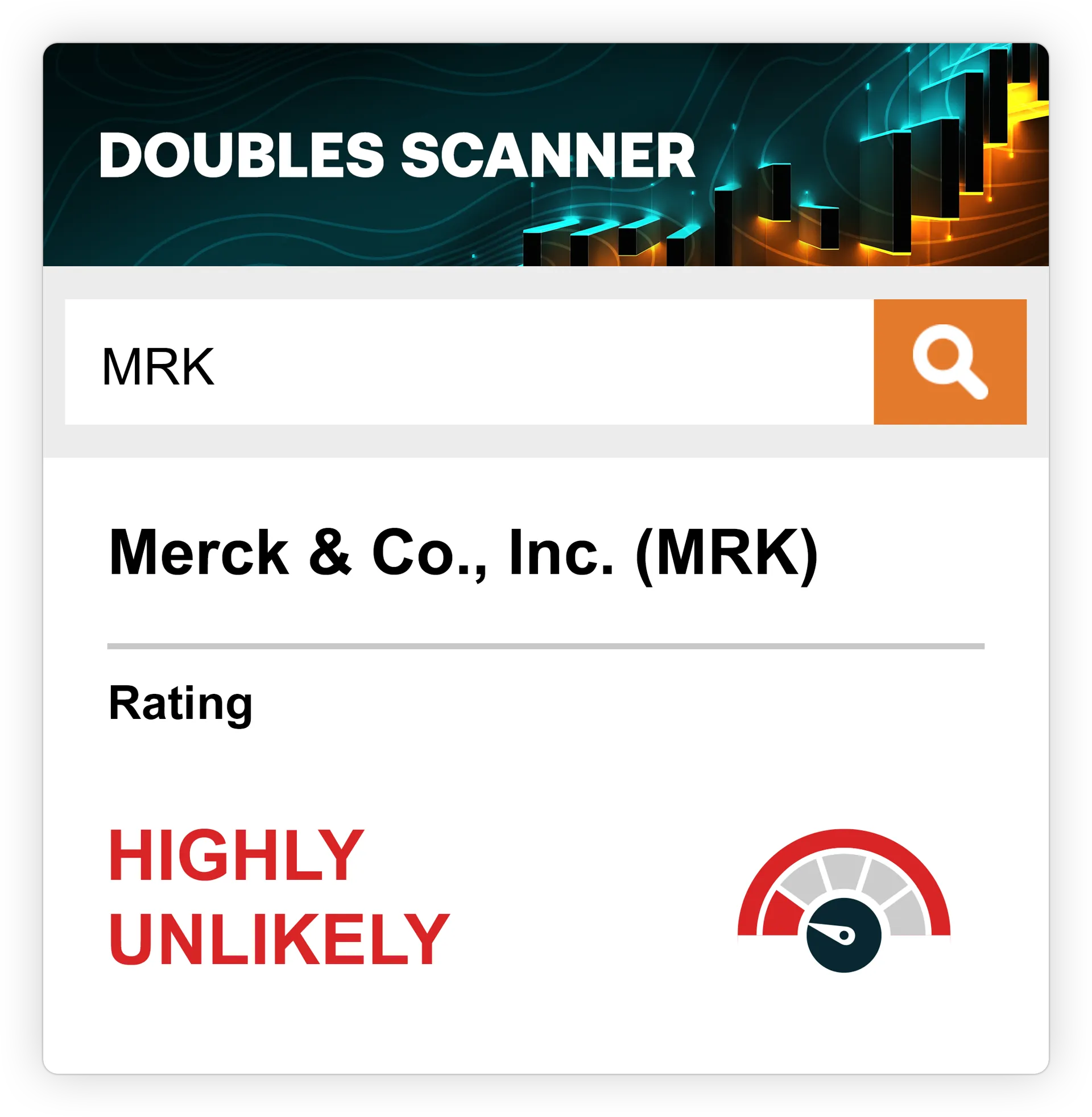

We’re calling it The Altimetry Doubles Scanner.

Using it is as simple as plugging in the company name or ticker symbol for any of the largest companies listed on the U.S. stock market.

The Doubles Scanner will then tell you, based on our system, whether the stock is “Highly Likely,” “Likely,” “Unlikely,” or “Highly Unlikely” to double in the coming months and years, before the “musical chairs” end for this rolling market.

Try it now – your access will stay open until our special briefing goes live on the evening of September 17.

And then be sure to tune into the special event to hear the secrets behind the system we’ve found to unlock this breakthrough... and much, much more.

In the meantime, here are two companies we’ve identified in the system...

One is Highly Likely to double in the remainder of this bull market, and the other is Highly Unlikely to double...

Stock No. 1: Broadcom (AVGO)

If Nvidia ends up not being the one chip maker to power the entire AI boom, the alternative most likely is not AMD, as many people think...

It will be Broadcom (AVGO), which rates as Highly Likely to double from here.

You see, when the AI hyperscalers are looking for someone to build them custom chips that are dialed in perfectly for what they need, they don’t go to Nvidia.

(Nvidia sells them its best chips, but it won’t optimize them for each customer.)

No, they’ll pick up the phone and call Broadcom.

Many people still think of Broadcom as a communication equipment maker. Its series of acquisitions and big R&D investments over the past two decades has turned it into a far bigger behemoth of custom chip making, cybersecurity, and datacenter connectivity.

And even that isn’t an exhaustive list of everything it’s doing.

Thanks to its innovation and its ability to bring its customers exactly what they need, when they need it, it is set up to have impressive performance moving forward.

But that doesn’t capture the real reason we’re so confident it’ll double from today, if you held it for the remainder of this bull market.

To learn why we’re so confident, tune in on September 17.

Stock No. 2: Merck (MRK)

Outside of the COVID vaccine, if you asked anyone what drug has had the highest annual revenue, most people would guess Ozempic...

Yet Ozempic barely breaks the top three!

Number one, coming in at almost 2x Ozempic in 2024, was Merck’s (MRK) cancer treatment, Keytruda.

Ozempic generated $16.7 billion in revenue. Keytruda produced $29.5 billion.

Merck has been one of the most innovative companies the world has seen over the past few decades. It has built its Keytruda franchise into an absolute powerhouse.

On top of that, it has six other drugs that generated over $1 billion in revenue in 2024. Not to mention, it has countless blockbusters in the pipeline for the coming years.

And yet, with this blockbuster having partial patent expiration in 2028, many are asking whether Merck’s massive pipeline of innovation will continue to be able to fuel its growth going forward.

The company’s impressive rise and its looming patent cliff are a real pressure for the business.

Which is why Merck (MRK) currently rates as Highly Unlikely to double from here.

But just like for Broadcom, that doesn’t explain the real reason we’re circling Merck as a company that is going to struggle to keep up with this bull market... or potentially crash in the weeks and months ahead.

Our Special Event on Sept. 17

Beginning Wednesday, September 17, the 'single greatest moneymaking anomaly in the U.S. stock market today' could help you separate stocks that will deliver gains of 200%... 500%... even 800% by this time next year...

And which stocks are DOOMED to crash up to 90%—or MORE.

For full details, you'll be hearing from Prof. Joel Litman and renowned Wall Street veteran Whitney Tilson.

Together, they'll show you why this anomaly could be your key to taking advantage of the next wave of companies set to soar 100% or more in 2025...

For an average potential gain of 150% or more on any stock you buy, based on Joel's historical study of thousands of stocks that have doubled over the last 30 years.

BUT only if you get in immediately—before earnings season kicks off in just a few weeks.

This urgent broadcast will begin at 8 p.m. Eastern time on Wednesday, September 17, at www.Breakout2025Event.com.

In the meantime, simply keep an eye on your inbox for updates leading up to the event.

Regards,

Rob Spivey, CFA

Director of Research, Altimetry